Maryland Standard Deduction 2025. Varies based on filing status. Maryland provides a standard personal exemption tax deduction of $ 3,200.00 in 2025 per qualifying filer and $ 3,200.00 per qualifying dependent(s), this is used to reduce the amount of income that is subject to tax in 2025.

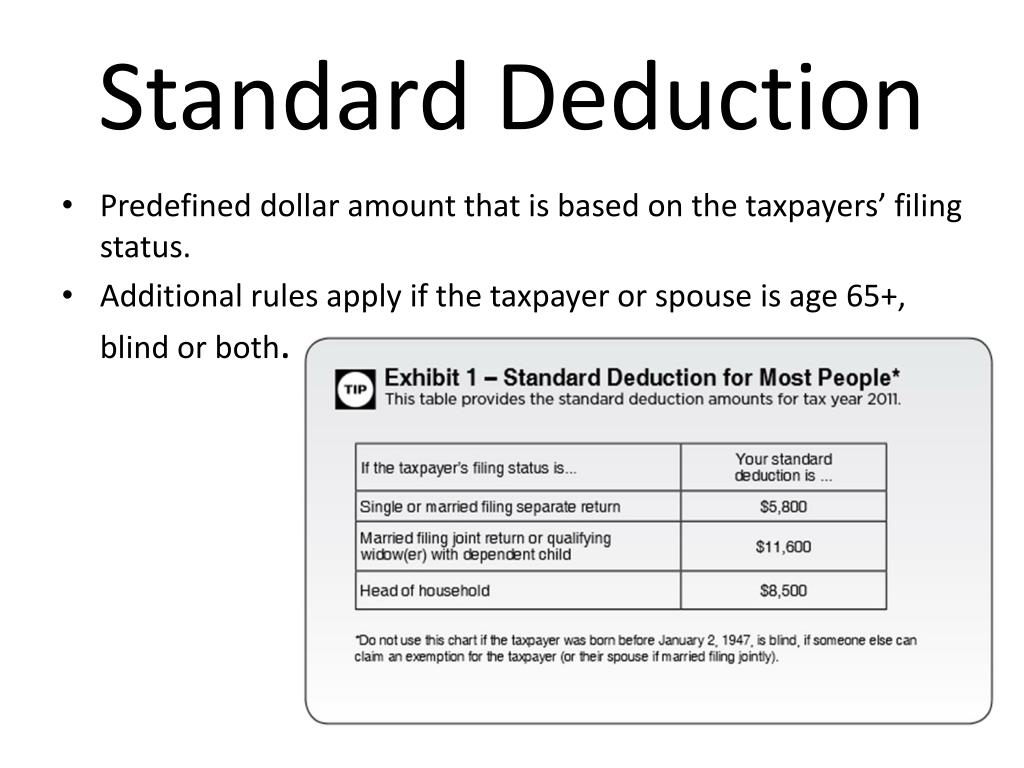

For the 2025 tax year, the standard deduction for single taxpayers and married individuals filing separately will rise to $15,000, up by $400 from 2025. The standard deduction amounts will increase to $15,000 for individuals and married couples filing separately, representing an increase of $400.

Maryland State Tax Standard Deduction, Maryland provides a standard personal exemption tax deduction of $ 3,200.00 in 2025 per qualifying filer and $ 3,200.00 per qualifying dependent(s), this is used to reduce the amount of.

Standard Tax Deductions For 2025 Idalia Gaylene, For single filers, the standard deduction is set to increase to $15,000, up $400 from the current amount of $14,600.

Standard Deduction Decrease In 2025 What It Means For Taxpayers, The maryland standard deduction is available to taxpayers who do not itemize their deductions.

Standard Deduction Decrease In 2025 What It Means For Taxpayers, Maryland offers various deductions and credits that can reduce your tax liability:

2025 Standard Tax Deduction Married Jointly Sib Lethia, Maryland single filer standard deduction.

Iowa Standard Deduction 2025 Jayme Melisse, The amount of the standard deduction varies depending on.

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)